MEASURE AB1167 SHOULD BE APPROVED TO REINFORCE A LEGAL FRAMEWORK THAT TODAY ALLOWS INEFFICIENT AND COSTLY REGULATION FOR TAXPAYERS.

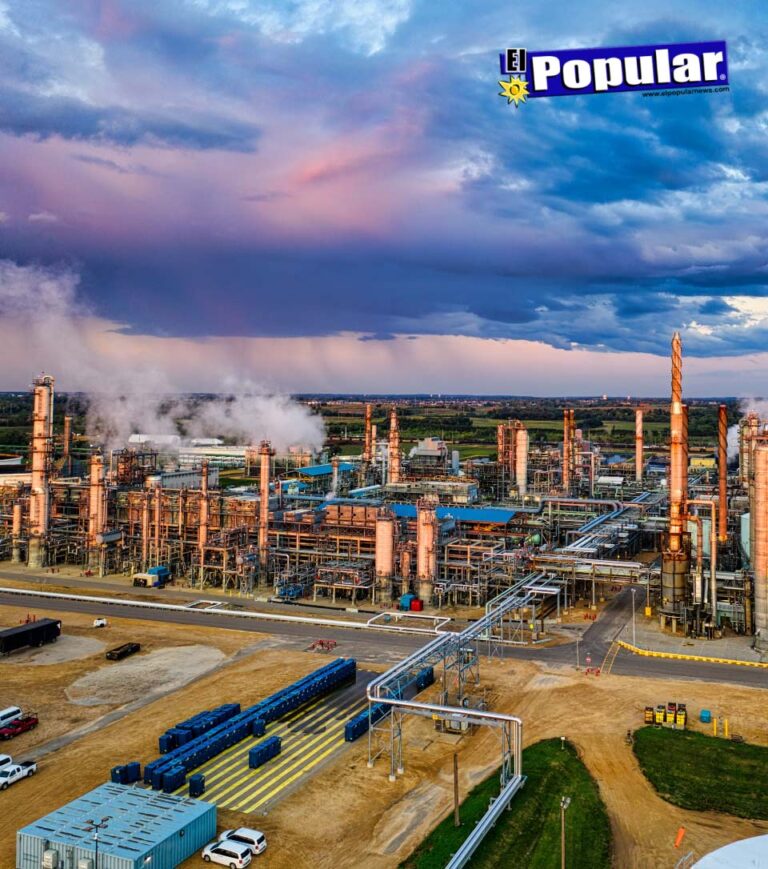

The end of California’s golden age of oil left waste where once there was wealth. The industry that invested in and got rich off the oil wells doesn’t want to pay the price for cleaning up its waste. It leaves the bill to California taxpayers.

The path to correcting a simple liability issue is decided in a few hours when Assemblywoman Wendy Carrillo’s AB 1167 is voted on. A measure that, combined with current legislation, creates a regulatory framework far more adequate than the present one to hold those who benefited from oil drilling financially accountable after their cleanup when they have outlived their usefulness.

Four years ago, AB 1057 gave the Division of Geological Energy (CalGEM), in charge of oil extraction, discretionary authority to guarantee the cleanup of boreholes through the payment of bonds. This proved insufficient to cover the actual cost of the procedure.

The California Council on Science and Technology (CST) estimated the average cost of cleaning up a well in our state at $68,000; while the official estimate of funds available per well is just over $1,000. The difference is a hit to taxpayers’ pockets. Regulation needs to be enforced to meet the goal of making those who took abundant profits pay the bill.

The Orphan Well Prevention Act measure, under consideration by the Capitol, puts an end to this bad deal for Californians. The bill prevents wells from becoming “orphaned” without a solvent operator by prohibiting the transfer of a well to another owner unless whoever sells provides a financial guarantee to pay the full cost of cleaning it up, a process called plugging and abandonment.

That means that no California well can be sold until the buyer – large or small, creditworthy or not – guarantees that cleanup costs are covered.

The measure is significant and urgent because of the amount of money it saves the state coffers, so that it can be devoted to more useful purposes rather than paying unpaid bills, and because of the amount of drilling shutdowns to come.

The CCST estimated that there are already 5,000 orphan wells and about 70,000 others identified as non-producing and marginal, on the way to orphanhood if nothing is done.

For example, Shell and ExxonMobil, which jointly operate as Aera Energy, agreed a few months ago to sell 23,000 wells, 38% inactive, to a German group. A ProPublica report indicated that Aera’s $3 million global bond will cover less than half of the $1.1 billion needed for the cleanup. The petroleum industry understandably opposes increased regulation because it can now say it pays a price for cleanup by saving hundreds of millions of dollars. It complains that the new measure will make future transfers more difficult, damaging the industry’s operation.

What is absolutely unacceptable is that the California Department of Finance is on the side of the oil companies instead of defending the taxpayers’ pockets. It is a case of the bureaucracy acting as a friend of the industry and, in the face of legislative pressure, defending its ineptitude by opposing change.

The California Department of Finance explained that the process established by AB 1167 duplicates some measures and actions that are already on the books today with CalGEM in charge of implementation. That means there may be an increase in costs, which is why state officials prefer to keep everything as is.

That is precisely the problem. The state regulatory agency has already proven to be ineffective in fulfilling this mission entrusted to it.

An investigation by The Desert Sun and ProPublica showed that monitoring is deficient, that it is not known if the oil company complies with the state’s orders after being intimated. Most fines are under $5,000 despite having the authority to fine $25,000 per day for non-compliance and, as if that weren’t enough, it also doesn’t bother to collect what it is owed. If CalGEM does not comply, legislative action is needed to make it do so.

Oil companies oppose the increased regulation saying it may cost more money. In fact, the savings in funds is achieved by reinforcing the system so that CalGEM better monitors wells, fines violators, collects the penalty from them, and ensures that those responsible for oil exploitation do not evade their responsibilities by selling up or declaring bankruptcy.

To accomplish that, passing AB 1167 is imperative. Californians have other priorities that need funds to spend their money than to throw it away paying the oil industry’s bills.