The state government should demand that these billion-dollar companies fulfill their duty and pay for shutting down the tens of thousands of inactive or decommissioned oil wells.

Three giant oil companies own 70% of the more than 40,000 inactive or decommissioned oil wells out of the total of more than 100,000 existing wells in California. They are, according to a new Sierra Club study released last week, Chevron, California Resources Corporation and Aera Energy.

Chevron is known to have the state’s largest earnings – 19.1 billion in 2022 alone – after Meta (which owns Facebook) and Apple.

California Resources Corporation split off from the giant Occidental Petroleum in 2014.

And Aera was sold last year by Shell and Exxon to a European investment firm whose purpose is to make the most profit in the shortest possible time.

The Sierra Club document states that Chevron has 9,055 inactive wells and it would cost 1.7 billion dollars to close them down. In 2022 its profits were 35,500 billion. For Aera, the numbers are 8,943 wells at a decommissioning cost of $1.8 billion with a combined profit of $98 billion in 2022 for its two previous parent companies. And California Resources Corporation has 6,658 unattended wells whose ultimate closure would cost $1.7 billion, but its profit was $13.8 billion.

Between the three, the companies have reported profits of nearly $150 billion in 2022. In one year alone they earn 14 times more than what it would cost to properly decommission the wells.

All three are among the richest and most profitable companies in the world.

And yet, they do everything in their power to avoid having to comply with their social responsibility and legal obligations.

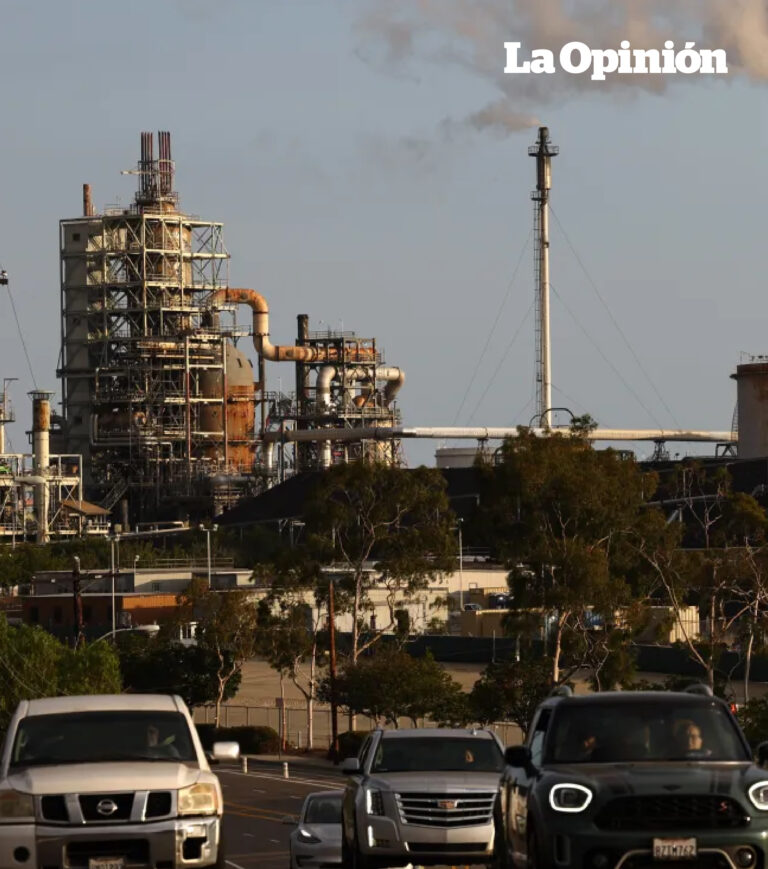

These are thousands of oil wells that swarm the inhabited areas of Southern California, in the midst of low-income residences, mostly Latinos, causing all kinds of short- and long-term illnesses.

According to the California Department of Conservation, “Plugging and abandonment involves permanently sealing the well with a cement plug to isolate the hydrocarbon-bearing formation from water sources and to prevent it leaking into the surface.”

If not properly plugged, these wells continue to pollute the environment by leaking benzene, a carcinogenic element. And in two out of three cases they emit methane, one of the most dangerous gasses that creates the greenhouse effect contributing to global warming.

In a previous article on this subject I supported passing AB 1167, which addresses the original wells owners’ practice to shrug off their responsibility by selling them to other companies whose hope was to try to extract the last drops of oil. All too often, these companies lack the means to permanently plug the wells and, in order not to comply, declare bankruptcy. In doing so, they cause incalculable damage to the population, especially in Los Angeles, Kern, Fresno, Ventura, and Santa Barbara counties. The cost of closing the wells thus falls on public funds.

AB 1167 was passed. Good timing. But it only covers future well sales and says nothing about what to do with the 41,568 existing wells waiting to be permanently closed.

This is where the situation gets complex. The state has the regulatory authority to make the oil companies pay to shut down the wells, but they in turn have the resources, and the legal defense, to instead pay a small sum each year to keep the non-productive wells in perpetuity. This is $150 to $1,500 per well per year, compared to about $225,000 to shut them down properly. The result is that the wells continue to pollute.

Additionally, they can adhere to the state’s Inactive Well Management Plan in the Department of Conservation, which allows them to reduce the number of plugged wells each year to 5% of the total inactive wells.

Again, the study demolishes the fallacy that the three oil companies lack the money necessary to fulfill their duty to the community. The truth is that they are so large that doing so would cost them a fraction of their revenues. The price to permanently plug all of California’s thousands of inactive wells would take 6.8% of their annual revenue – about $10 billion, and 15% of the decommissioned wells.

The bottom line is that nothing changes, and that the lack of action benefits those who exploited the land for inconceivable profits at the expense of the surrounding population and then abandoned it for others to deal with the problem they created.

The problem and anomaly is that California law currently makes it difficult to impose financial responsibility on the industry.

Meanwhile, the number of unused wells is increasing rapidly in California, and crude oil extraction fell by 42% between 2014 and 2022.

This decline, which the industry considers irreversible, could mean the abandonment of the Californian market by oil companies, leaving more than 100,000 open and polluting wells in their wake at any given moment.

Whether 100,000 or the current forty thousand, these wells cannot stay that way, because if left unmaintained they can rust or crack, says a report by CalGEM, the Division of Geologic Energy Management in the California government, causing further damage.

“Poorly maintained well casings can be damaged allowing contaminants such as uranium, lead, iron, selenium, sulfates and radon to enter freshwater formations…damage to inactive wells can go unnoticed.”

The existence of extraction wells near residences is an aberration and all of them should be closed. But at least in the meantime, the closure of those wells that no longer produce anything should be completed.

The problem is gigantic – we are talking about 100,000 decommissioned wells statewide, of which 41,000 are orphaned or “probably orphaned,” meaning they have no known owner or operator.

The Sierra Club document concludes with a call to action: “To protect residents and ensure that California’s limited state budget is not burdened by the enormous cost of oil well cleanup, immediate political action is needed by the state legislature and Governor Gavin Newsom to close industry loopholes and demand an urgent timeline to plug these wells. If California fails to act, residents will have to foot the bill for a disaster created by hugely profitable multinational corporations.”

It is important that these details are known, and that pressure is put on the state government to demand that these multi millionare companies comply with their duty and pay for closing the oil wells.